Dental Insurance Is Changing Dentistry: Here’s What You Can Do About It

Dental insurance reimbursements continue to decline as the cost of practicing dentistry increases. In fact, every few weeks we hear about another dental insurance company that has lowered reimbursements to the PPO level or eliminated a better-paying plan. As this reality is highly unlikely to change, practices must adopt new strategies and techniques to remain successful.

MAKING DENTAL INSURANCE WORK FOR YOU

The unfortunate truth is that in the overall battle of reimbursements, dental insurance companies are winning. Many of the larger plans have so many customers that they can dictate reimbursements to dental practices with little to no pushback. The good news is that with the right strategies, dental practices can make the most of this seemingly bleak situation. Here are some ways to help make dental insurance work better for you.

The unfortunate truth is that in the overall battle of reimbursements, dental insurance companies are winning.

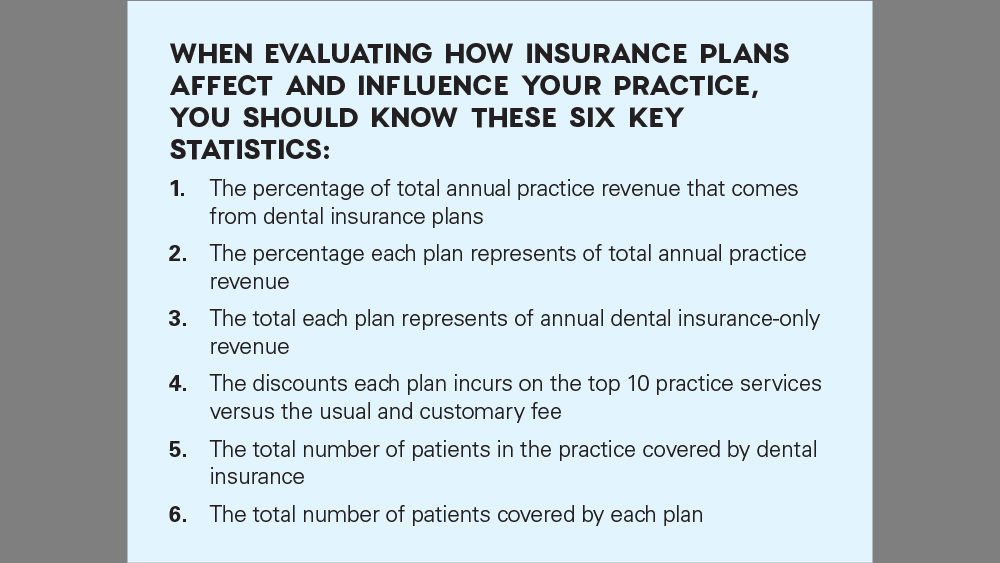

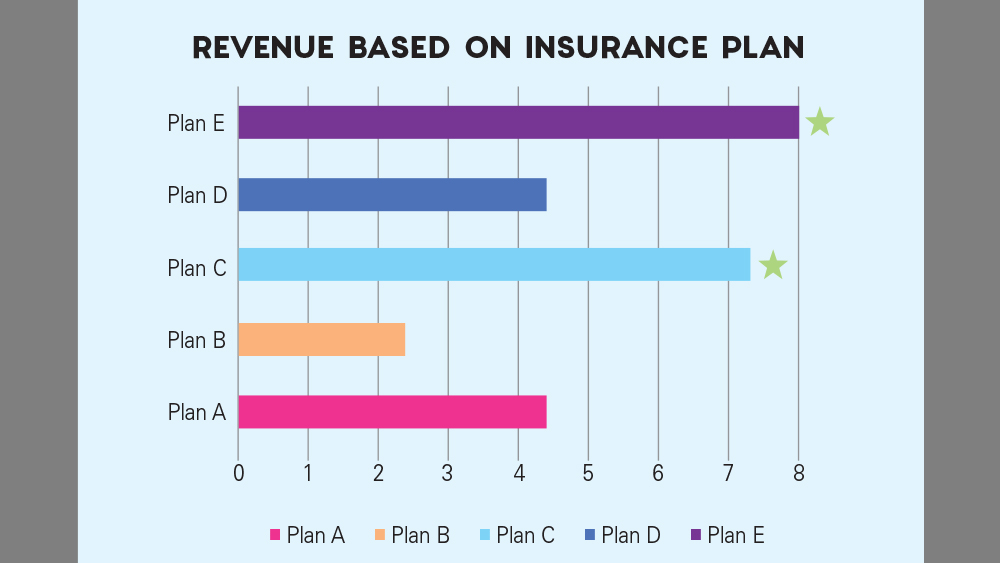

- Start with an analysis. The starting point of all decision-making and strategy should be analysis. Many dental practices know little about the statistics pertaining to their dental plans and how they affect the practice. Performing an insurance analysis will give you a complete understanding of your unique dental insurance situation and its impact on your practice. Then you can design strategies to help maximize your plan participation and make better decisions when evaluating future participation.

Having a firm grasp of these statistics is critically important in helping you understand where your practice stands with regard to dental insurance, so that you can make effective strategic decisions. More specifically, they can aid you in determining which plans warrant your participation, whether or not your participation is profitable, and when the time may be right to exit a particular dental insurance plan.

Evaluating key statistics on dental insurance and its effect on revenue empowers strategic decision-making, and can help you decide which plans are best serving your practice.

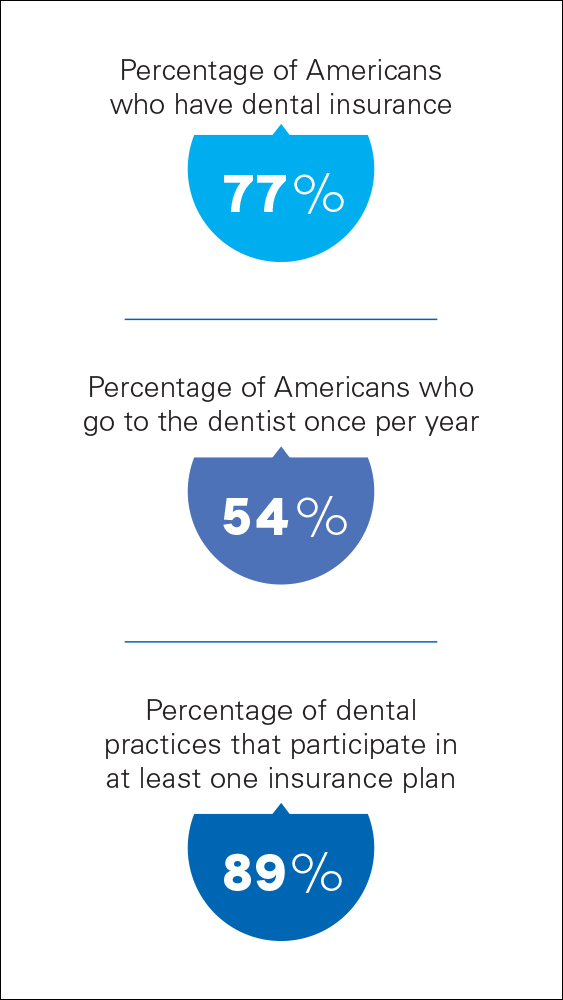

- Encourage patients to maximize their dental insurance benefits. Many patients have extensive dental needs, yet they don’t take advantage of their annual insurance benefits. Why? Some forget about it, while others may put it off — but many other patients simply don’t know the details of their dental benefits. When patients are informed that their dental insurance pays for part or all of their treatment, they typically become highly motivated to schedule appointments. However, practices must be proactive in helping patients understand that they receive annual benefits that contribute toward completing recommended treatment. Given that 89% of practices participate in at least one dental insurance plan, this just makes good business sense.

- Reach out to patients every September. September is an excellent month to contact patients about their remaining benefits and treatment for the year. Try this highly effective script:

“Mrs. Jones, we were reviewing your records and noted that you have not completed the XYZ treatment recommended at your last visit. You may be interested to know that you have $500 left of your insurance benefits to use before the end of the year. Let’s schedule a convenient time for you to have your treatment completed.”

Take note of the psychology in this script: You’re telling patient that they have available money that will be taken away if they don’t use it. This is a powerful message that works extremely well. Patients are not inclined to let anyone take away their money, and chances are they will schedule the appointment to make sure they get what is due to them.

- Reach out to patients every January. No matter how hard you work to explain the value of dentistry to your patients, many will nevertheless halt treatment once they have run out of insurance benefits. So it’s a smart strategy to call patients in early January to let them know that their benefits have renewed and they have remaining treatment. Here is a simple script for this type of call:

“Mrs. Jones, I am calling with wonderful news. We were reviewing our records and noted that you have not completed the treatment recommended at your last visit, but your insurance benefits have renewed and you now have $1,000 to put toward the treatment. Let’s schedule a convenient time for you to have your treatment completed.”

Once again, patients are highly appreciative of the practice proactively contacting them and telling them they now have money to put toward their treatment.

Dental practices must be proactive about consulting with patients and aiding their understanding about annual benefit allowances.

- Be as efficient as possible. Declining insurance reimbursements will force practices to work toward increasing patient volume and procedures in order to maintain their revenue levels. This will require practices to implement systems that allow for maximum efficiency and effectiveness. One of the best ways to achieve this without stress is to rely on experts. Practices should work with companies and organizations that provide excellent customer service, leading-edge expertise or quality products, and have a commitment to helping their customers.

Practices that accept dental insurance, understand how it affects their practice, and make strategic decisions that help offset lowering reimbursements will be poised for stability and increased success.

For more information on the practice-management consultation services offered by Levin Group, Inc., contact Dr. Levin at rlevin@levingroup.com or visit levingroup.com.